If one’s total taxable income, excluding STCG, is below the minimum taxable income of Rs. Short-term capital gains arising from the sale of listed equity shares are taxed at 15% under Section 111A. Step 5: Capital gains are of two types - short-term capital gains and long-term capital gains.

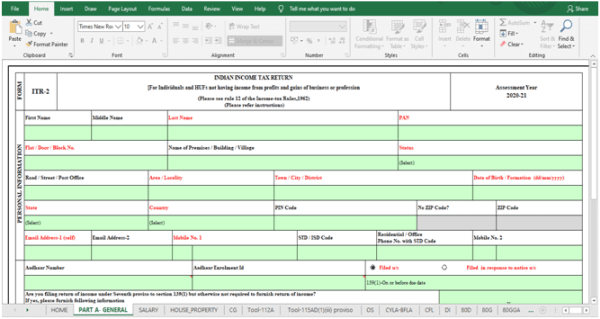

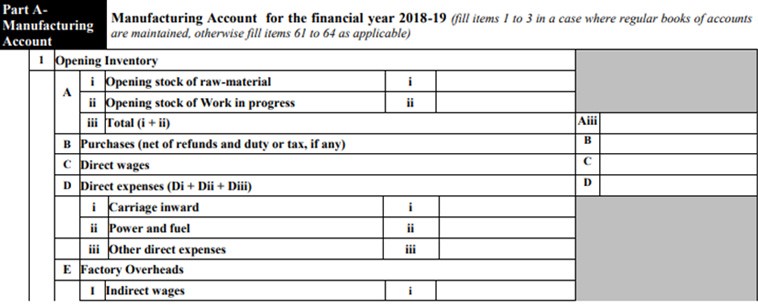

After that, they have to tap on ‘Schedule Capital Gains’ and then choose the type of capital assets from the provided list. Taxpayers have to select ‘General’ and click on ‘Income Schedule’. Step 4: The next page will show 5 different types of schedules. After that, they need to select ‘Taxable income is more than basic exemption limit’ as the reason for ITR filing. Step 3: Now, individuals have to select the assessment year, choose the status and select the type of form. Step 2: Then, they need to follow this path: e-File> Income Tax Returns> File Income Tax Returns. Step 1: First, one has to visit the official website of the Income Tax department and log in with the necessary credentials. Here’s a step-by-step guide for the same. One can do it online via the official Income Tax department portal. Individuals receiving capital gains through the sale of equity have to file IT returns every year. Taxpayers with income from salary, property, capital gains, foreign assets and others are eligible to file ITR 2. The following sections cover the steps to file ITR 2 form for those earning capital gains.

HUFs and individuals with income other than those under the ‘Profit and Gains from Business or Profession’ head have to use ITR Form 2 for filing IT returns. The ITR form that taxpayers have to use for filing income tax returns will depend on their residential status and total income obtained from different sources.

0 kommentar(er)

0 kommentar(er)